About once a week I have a conversation with a founder where they say something like, “We’re not interested in just any buyer. We’re really looking for a strategic buyer.”

Of course you want a strategic buyer, because they’re likely to pay more for your business. It makes sense to do everything you can to find one.

But the truth is, most strategic deals happen when the buyer approaches the seller — not the other way around.

Strategic deals are more likely to happen when the buyer reaches out to the seller because in that scenario, so many of the foundational pieces of the deal are already in place:

- Synergies: The buyer has identified that the company they’re eyeing would fit well into their strategic roadmap, or would create synergistic opportunities for the business that could be lucrative.

- Funding: The buyer knows they have money to spend, and they’re willing to fund this transaction.

- Resources: The buyer has the bandwidth and is willing to put the effort and resources into an acquisition and an integration.

With all of these pieces in place, there’s only one big wild card: whether the seller’s interested, and at what price. Can you come up with a deal that’s a win-win for both parties?

That’s why strategic deals where the buyer approaches the seller sometimes end up with crazy high sale prices. Because the buyer is motivated, and the seller has all the leverage.

How common are strategic acquisitions, when the buyer approaches the seller?

So how often do deals happen whereby a buyer approaches the seller?

It’s actually quite common.

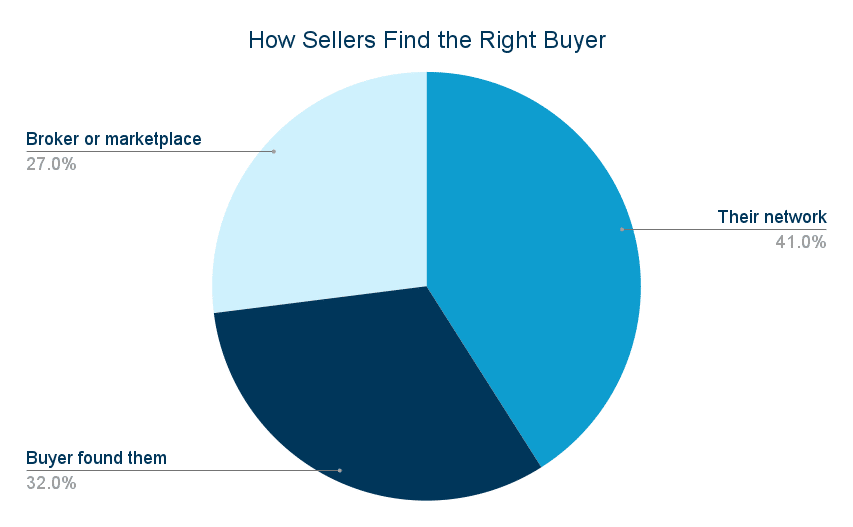

Here’s how deals come about, according to our research of thousands of deals, including agencies, software, media, and e-commerce companies:

You’ll notice that the most common way sellers told us they connected with their buyer — 41% — was through their network. That could mean they worked with them previously, or reached out to them directly.

The next most common way was when the seller was approached by the buyer. That happened in 32% of the deals we’ve collected information about.

And in 27% of the deals we’ve covered, the seller leaned on an M&A advisor or a marketplace to find a good buyer.

How strategic deals typically play out

When this all goes smoothly, the seller typically makes out really well. That’s why strategic deals — where the buyer has a strategic reason to do the deal, even if it means paying more for the business — are M&A’s golden child.

With a strategic deal, the buyer is invested in making this deal happen; they really want to buy the business.

The seller, then, has more leverage. This seller is likely running a profitable business that has plenty of potential to grow, which is why it was appealing to the buyer in the first place.

That means the seller doesn’t have to sell — in fact, they probably weren’t even considering it until this interested party showed up — and probably won’t sell unless it’s an incredibly favorable offer.

This is why you see reports of strategic deals where a company sells for a crazy EBITDA multiple. The buyer had the vision, the strategic plan, the funding, and the willingness to make it happen, and the only missing piece was getting the seller on board. The seller often does incredibly well in these transactions.

Now, can you imagine trying to orchestrate a strategic deal as a seller who’s looking to exit?

Your vantage point isn’t nearly as strong. These deals do happen, but the likelihood of it all working out with a crazy multiple involved is so much lower than when the buyer approaches the seller.

Say you want to sell, so you decide to pitch your ideal buyer. This can be an effective approach, so long as you have realistic expectations around a sale price. It’s unlikely to yield crazy strategic multiples, unless you can get more than one potential buyer highly invested and prompt a competitive bidding process to push the price up.

Once you approach your ideal buyer, they need to check a number of boxes before a deal can become possible. Your target buyer needs to:

- Be interested in making an acquisition

- Clearly see how acquiring your business fits into their strategic road map and makes their company more valuable

- Have the funds necessary for the transaction

- Have the resources and bandwidth to both navigate a transaction and then achieve a smooth transfer and integration

On top of this, if you’re looking for an above-market multiple — which is what sellers typically mean when they say they’re looking for a strategic buyer — the buyer has to be in a position where your business is not just interesting, but would increase the value of their business in a meaningful way. Such a meaningful way that they’re willing to pay an above-market rate for the business.

This is a difficult checklist to crack, and a challenging puzzle to piece together. Much more complex than when the buyer approaches the seller.

Plus, when it’s you who does the approaching, your target buyer has the leverage. Like the seller who gets approached by a buyer, a buyer who gets approached by a seller has nothing to lose.

Examples of deals with strategic buyers

Here are a few examples of strategic acquisitions:

Backlinko: A content company that sold for mid-7 figures. The buyer approached the seller.

Span Health: A coaching app that sold for 7 figures with $300K ARR. The buyer approached the seller.

Honeymoons: A content site with an aged domain that sold for 6 figures, or 7x revenue. The buyer approached the seller.

PR360: A public relations agency that sold for 7 figures. The buyer approached them after they’d worked together.

The Hustle: A media company that sold for $20M+. The buyer approached the seller.

Ardius: A SaaS firm. They had a partnership with the buyer and a similar customer base.

Hidden Levers: A SaaS that sold for 16x ARR. They used an M&A advisor to drum up buyers and ran a competitive bidding process.

CSS-Tricks: A content site that sold for $4 million. The buyer approached the seller.

Much of this is serendipity. You can’t control whether a buyer reaches out to you with interest.

But say you could influence your company’s future by making your business attractive to a buyer? How would you go about doing it? Let’s talk about that next.

How to attract a strategic buyer for your business

So we know the best-case scenario for a seller is having a buyer approach you. But if you wanted to increase your chances of a strategic deal, how would you attract a strategic acquirer?

Truthfully, you don’t. This is pretty much impossible to orchestrate. And most experts advise against changing parts of your business with the goal of attracting a particular buyer, because chances are that will never come to fruition.

But there are a few things you can do to position yourself to be attractive to buyers more generally. And the best part is, doing these things also helps you build a better business.

So even if a buyer never comes knocking — even if you have to approach buyers on your own, or use an M&A advisor to find buyers — you win.

Here are a few ideas for setting up your company to be attractive to strategic buyers:

Build a cash-flowing business. Every acquirer — and every business owner — wants to run a profitable business. And your profit – typically SDE or EBITDA – is the number one factor in how much a buyer is willing to pay for most companies.

Treat your customers and partners well. Again, this is good business, but it also sets you up to generate opportunities. It’s common for sellers to be acquired by a partner or a client, in part because that close relationship offers visibility into the health of the business. Foster those relationships, and you might benefit from it down the line.

Network in your industry. Knowing other players in your space could bring you new business, and it also opens people’s eyes to what you’re building. That creates opportunities for partnerships, which could turn into something bigger.

Build partnerships. Because partners are a common acquisition target, it behooves you to create partnerships whenever you can. You want partnerships that are good for the financial health of the business, but sometimes it also makes sense to build partnerships just to foster that relationship, even if the direct ROI is hard to measure.

So reach out to competitors in your space and companies that serve a similar audience, and look for ways to partner with or support them.

You’re not trying to lure a buyer. Your goal is simply to get on the radars of these companies, so that over time, you might become an acquisition target.

Build a trusted brand. Offer something that’s better than your competitors, so you’ll become known in your niche. This trust and branding is real currency that compounds over time.

Keep solid books. Having accurate insight into your financial situation helps you make good decisions for the business. And if a buyer comes knocking unexpectedly, you’ll be in a good position to share accurate numbers that set an initial discussion on the right track.

Understand how M&A works. And tweak your business accordingly. You’re already doing this by reading They Got Acquired. If you’re thoughtful about how you build the business and make optimizations now, your business will be more valuable later.

What if you don’t get an unsolicited offer from a buyer?

What happens if you don’t have an unsolicited offer? You’re in good company.

If you want to explore selling and don’t have buyers coming to you, here are your next-best options:

Pitch your ideal buyers. In an ideal world, you’ll elicit more than one interested party. High demand gives you leverage and will drive up your sale price.

Work with an M&A advisor, broker or investment banker. You’ll need at least $250,000 in revenue to be an interesting client, and you’ll want to find an advisor who comes recommended, so you can avoid any bad actors. We’re happy to introduce you to an M&A advisor who specializes in your type and size of business.