How to sell your business: Our 1-hour, quick-start course

A primer on how to sell your company

So you’re thinking about selling your business — or maybe you have an unsolicited offer and aren’t sure where to go from here.

In just one hour, you’ll learn:

- What to expect from the sale process

- Your options for finding a buyer

- How to create your own roadmap to sale

Let’s get you one step closer to clinking those champagne glasses.

Rooting you on

You deserve to make bank

You’ve put a lot of work into building your business.

Now it’s time to get back that value you’ve created. It’s time to reap the rewards of your effort.

The best way to position yourself for a successful sale is by understanding what’s ahead.

Most entrepreneurs are heads down building their business. So when it comes time to sell, you face a steep learning curve.

Yet knowing what levers to pull and which experts to lean on can drastically increase the value of your business at sale.

That’s why we’ve compiled everything you need to know at a high level about selling your business into this course.

Time commitment: One hour

Format: Video

Short videos are easy to digest, and we explain everything in layman’s terms, so it’s easy to understand.

The modules

What you'll learn

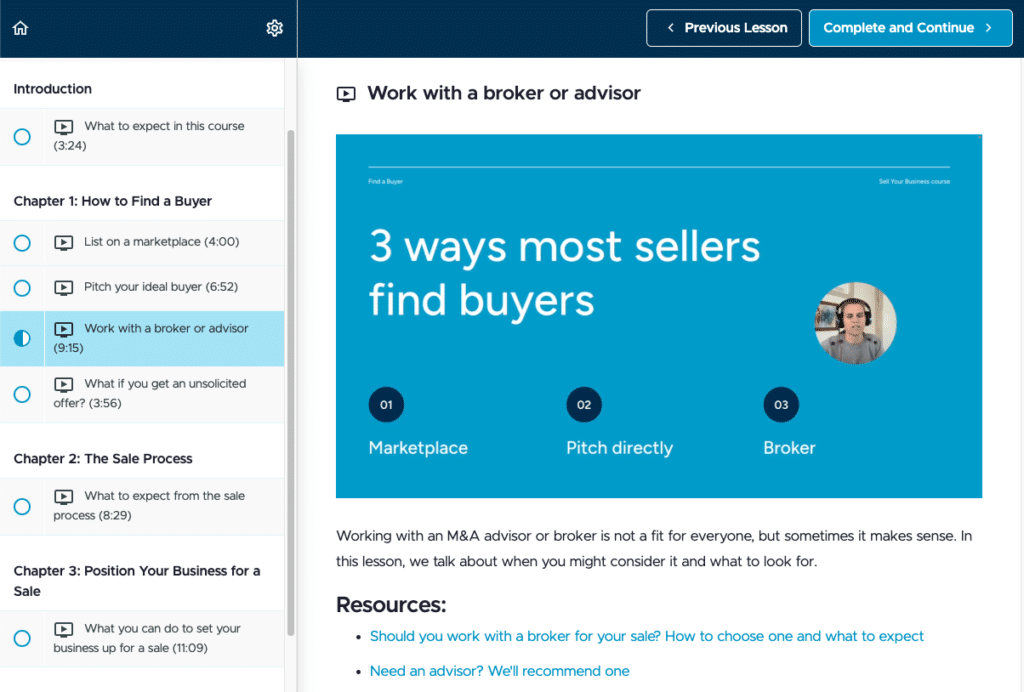

Screenshot from the course

Here’s what to expect in the course.

Chapter 1: How to Find a Buyer

24 minutes

- The common ways most sellers find buyers

- How to drum up more offers by pitching your ideal buyer

- The pros and cons of working with a broker or advisor

- How to find an advisor that’s right for you

- What to do if you get an unsolicited offer

Chapter 2: The Sale Process

8 minutes

- What the process looks like and how long it might take

- Where in the process you should make sure you have a lawyer

- Mistakes to avoid in your Letter of Intent

- What to expect from the due diligence phase

- How to think about the post-sale phase, including earn outs

Chapter 3: Positioning Your Business for a Sale

11 minutes

- Which levers you should pull to maximize valuation

- How revenue and profit play into valuation

- Documents you can prepare now so you’re ready

- Other tips for improving your chances of an acquisition

- Why you’ll be happy you took these steps even if you never sell

Chapter 4: Frequently Asked Questions

9 minutes

- How can I figure out what my business is worth?

- Should I sell now, or later?

- Is my business sellable?

- What professionals do I need to help me?

- Glossary of common terms and acronyms

Chapter 5: Next Steps

3 minutes

- How we can help as you move forward

Peek inside

Watch the course introduction

Want a taste of what this course will be like and what you’ll learn?

Here’s the 3-minute introduction that’s actually part of the course.

Introduction video:

Who we are

Meet your instructor

Alexis Grant (Lexi) is Founder & CEO of They Got Acquired.

She has sold two content businesses, including the acqui-hire of a boutique content agency (2015) and a website for writers (2021).

She’s not a broker or a lawyer. She’s an entrepreneur and a writer, and one of her superpowers is sharing complex ideas in layman’s terms we can all understand.

Lexi enjoys connecting with and learning from other founders — and best of all, watching you meet your goals.

Why we created this course

A note from our founder

Here’s the honest truth: When I launched They Got Acquired, I did not set out to create a course business.

But as I talked to founders looking to sell, I realized this is what will best serve our community: a short, easy-to-digest course that covers all the basics.

In my first year running this company, I took nearly 100 calls with founders looking to sell.

They were all at different stages: some had received an unexpected offer, some were just starting to think about selling, and others were mid-way through the sale process and wanted another opinion.

Yet everyone asked similar questions:

- What’s the best way to find a buyer for my business?

- What should I expect during the sale process?

- Who should I hire to help me?

- Is my business even sellable?

This course answers all of those questions, and then some.

It shares what I’ve learned through selling my own businesses, talking one-on-one with founders and M&A experts, and publishing 100+ stories about companies that sold.

In the future, I envision us going deeper on certain topics, and leaning on others who can share their expertise.

But this course is high-level, giving you all the information you need to get started.

Spend just one hour with us, and you’ll be positioned to create your own roadmap for selling your business.

When you make that sale, I hope you let us know so we can feature you.

Rooting you on,

Alexis Grant (Lexi)

Founder & CEO of They Got Acquired

What People Say

“This course is highly actionable and to the point. Even after two exits, I found tremendous value in this resource and am using it as a guidebook, currently. The ROI is exponential.”

– Kevin Kermes, founder of Career Attraction

“It’s a great high-level overview… It helped highlight areas that I’d want to dig into and improve if I was taking a longer term approach to running and selling my business. And, since I’m actively looking to sell, it helped me identify red flags that I’ll likely need to address.”

– Anonymous

I wish this knowledge bomb was around when I sold my two companies!

– Terry Dunlap, founder of Refirm Labs

Are you a fit?

Who this course is for

This course is right for you if:

- You’re thinking about selling your business and don’t know where to start

- You have an unsolicited offer and need to figure out the basics quickly (there’s a module for that)

- You want to sell in a few years, so you’re positioning yourself now to get maximum value

- You know a little about selling a business, and you want to know more

This course isn’t right for you if:

- You’ve sold a business before and know what you’re doing already

- You’re expecting to sell for more than $10 or $20 million — this course will provide a foundation of knowledge, but you might need different experts (like an investment bank) than we discuss here

- You’re selling a brick-and-mortar business — some of the information here will apply, but we focus on sales of online companies