Have you ever considered pitching your ideal buyer?

Lots of acquisitions come together this way. Whether you’re starting from scratch to find a buyer or have an interested party but want more offers for leverage, approaching potential buyers directly can be a smart move.

Some founders shy away from this approach or simply don’t realize it’s an option because it’s not often discussed. You don’t hear a lot of founders admitting this is how they connected with their buyer, because some worry it makes them sound desperate, rather than sought after.

But I’m here to tell you that many founders successfully sell their business this way. It’s smart and effective. And being proactive about finding a buyer puts you in a better position to land your dream exit.

How to pitch your way to an acquisition

I took this route myself when I sold a content site for writers, The Write Life, in early 2021. Back then I didn’t know a fraction of what I know now, and I didn’t have a network of founders who have exited to lean on; going through that experience was what prompted me to start They Got Acquired.

But I did a few things right, including drumming up multiple offers to create competition, which pushed up the price of the business. One of the ways I did that was by approaching potential buyers.

In this piece, I’ll offer tips for approaching potential buyers from founders who’ve successfully taken this approach. I’ll also share sample emails that actually worked. (Click here to skip to the samples.)

So here’s how to get started on pitching buyers for your company:

1. Figure out what you want

What does your ideal scenario look like? You don’t have to know all the details—it’s wise to stay open to possibilities—but you should know what your goals are for the acquisition.

Is it to set up your family financially? Do you care about your company continuing in its existing form? Are you hoping the new buyer keeps the existing team? Are you willing to stay on with a new buyer for a certain period, do you want an immediate exit, or are you open to either option?

Getting clear on your wants is a good starting point, because it will help you narrow down who to pitch and filter opportunities as they arise. For example, if you want to sell to someone who shares your company’s values, you can screen for that as you look for targets.

2. Nail down what makes your company valuable

Why might another company want to buy your business? What does your company bring to the table? What makes it attractive?

If you understand this from the buyer’s perspective, you’ll be better equipped to figure out who might be interested.

For example, when I sold my website for writers, we had a strong SEO presence and heavy traffic from Google. So that made the company naturally attractive to competitors in the space who wanted to bring in more customers via search.

You might have a few different angles to play on here. Get clear on your value propositions so you can move onto the next step: brainstorming who might want to buy the business.

3. Understand what your company is worth

It’s a good idea to understand how much your company is worth before you start pitching buyers, so you know what to expect in terms of offers. Here are two ways to do that:

Get a valuation

One way to get a quick, ballpark valuation is by using our quick valuation calculator. It will ask you a few questions and spit out an estimated valuation immediately.

This is a helpful starting point, but any valuation done this quickly is bound to overlook some of the nuances of your business. We can also follow that up with a complete valuation that gives a more accurate picture of what your business might sell for. If you want that full valuation from us, start with the quick calculator, and when you get the results, you can request a full one.

Look at sale multiples for your type of business

You can also estimate an approximate business value by looking at sale multiples for your industry. Here’s our guide to sale multiples, which will help you figure out how to do that.

Here’s the tricky part though: A business is really only worth however much a buyer (or multiple buyers) will pay. Sometimes that’s higher than the calculations would suggest, and sometimes it’s lower.

It’s helpful to understand how the market might value your business so you can use that intel to negotiate a better deal.

4. Create a list of potential buyers

Who might want to buy your company?

Create a spreadsheet of potential acquirers. This could include:

- Competitors in your space

- Your clients, advertisers or partners

- Bigger companies that serve a similar audience as you, even if they do it in a different way

- Roll-ups or private equity firms

You might also collect information on each of these companies, such as:

- News and press releases: Check out their press page to see what changes have happened in that company that might set them up for an acquisition; for example, have they recently raised funding?

- Other companies they’ve purchased: We can help with this through a custom report from our deal database

- Best contact: Depending on the size of the company, this is probably the CEO, but could be an M&A lead

When considering who might buy your business, look for companies that are a step or two bigger or further along than your business. Massive brands don’t typically engage in deals that are a few hundred thousand dollars. On the other end of the spectrum, the company has to be big enough to afford an acquisition.

In an ideal world, by the time you’re ready to sell, you already have a warm contact at each of your target companies. If you’re thinking ahead about how to sell in a year or two, work this list strategically; look for ways to support or partner with the founder you want to notice your business.

But if you’re coming at this ready to sell now, cold pitches can work, too. We’ve seen plenty of founders reach out cold to a potential buyer and have success.

Be smart about how many parties you contact. “It’s tricky, because you can’t just blast emails out to a large audience,” said Brian Casel, who sold his productized writing service company, Audience Ops. “You’d risk publicizing that you’re looking to sell, which could damage your business, client base, and/or your team finding out about a potential sale. So you should send messages only to a trusted private network.”

5. Send inquiry emails

Now’s the time to craft that email! But how should you approach the conversation? What do you say?

Here are a few tips for the email itself. And if you want examples of emails that have worked, we’ve included those near the end of this post.

Keep it short

CEOs at successful companies get tons of email, so they’re not interested in reading a long message.

That’s why it’s vital you are succinct in your initial contact. Don’t share why you want to sell or any of the details. Instead, simply let them know you’re thinking about selling, and would they be interested in learning more?

If you get a yes, you can follow up with details.

Be direct

Be upfront that you’re looking to explore an acquisition.

That’s what Jonathan Knegtel, founder of Blockdata, did when he reached out cold to Anand Sanwal, founder of CB Insights. Sanwal said it was “refreshing” to avoid “this weird dance that people do” and that’s partly why they ended up with a deal.

“We get a lot of [acquisition requests], and what I appreciated about Jonathan’s initial email was it was direct,” Sanwal said on the Wharton Fintech Podcast. “That’s one of the things a lot of people don’t do. They kind of talk around it. They’re like, hey, let’s partner, let’s exchange notes… So it’s really helpful when someone says, I’ve thought about what we’re doing and I think it could fit into what you’re doing and is just very clear about that.”

Consider the timing

What if you’re not ready to sell now and are warming up contacts for later?

That’s when it might make more sense to be more vague or open-ended and inquire about a partnership instead.

But if you’re clear on selling, most founders have found being bold and honest about that intent can work in your favor.

6. Craft a marketing document

What do you do when the person you pitch says they’re interested to learn more?

That’s when you send more details. It’s time to craft a marketing document that shares information about your company.

In most cases, this should be compelling but not fancy: a simple Google Doc or slide deck works. (When I sold my website for writers, which was a mid-6-figure sale, I used a Google doc.)

How much should you share in this marketing document? Lean toward transparency; the more you can share, the more likely you and the other party will quickly suss out whether this could be a fit.

One seller who took that approach was Laura Roeder, who sold MeetEdgar, a social media scheduling SaaS. “I was very transparent about all numbers right from the beginning,” she wrote in a blog post about the sale. “I didn’t want to end up in a situation where the buyer would find surprises during due diligence that would cause them to look at the deal in a different light.”

However, depending on who you’re sharing it with, you might not want to give away all your secrets. If it makes sense to withhold certain details—like a client list, if you’re talking with a competitor—let them know you’ll share that information as part of the due diligence process.

During the sale of Centurica, for example, seller Chris Yates held off on sharing certain details he considered the secret sauce of the business until he was confident the deal would go through. “I was guarded with information at first until I knew he had the funds to actually make the deal happen,” said Yates, who sold to a competitor.

Should you have the potential buyer sign an NDA before sharing any details? That’s up to you. It’s certainly not required, especially for early discussion, but some sellers choose to move forward with one. While some buyers see this as a natural step, others consider it overkill this early in the process.

In most instances, you’re better off not sharing an asking price for the business in the marketing document. Let that conversation happen after the buyer has reviewed your materials.

7. Get more than one offer

Here’s the key to increasing your sale price: Drum up more than one offer.

While it’s not always possible, it’s worth trying because it’s one of the top ways to get more return from your business.

Having more than one offer creates competition and gives you leverage, which can result not only in a higher sale price, but also in more favorable deal terms, like more cash up front or a quicker close.

Have trouble finding one or more interested parties? You could also try listing on a marketplace or working with an M&A advisor.

Depending on the size of your deal, you might want to work with an M&A advisor or broker even if you bring one or more buyers to the table, because they’ll help you negotiate the deal, including terms like payment structure. A good advisor has brokered dozens or even hundreds of sales, so they know what to watch out for.

If you want help choosing an advisor who specializes in your type of company and deal size, ask us. We can recommend one we trust.

Once you have offers, you’re off to the races. But before you sign a Letter of Intent (LOI), hire a lawyer to present you. And if you want more guidance? Our M&A coaching might be a fit.

Have a buyer and want support through the sale process?

We offer guidance to sellers who have an interested buyer, so you don’t have to navigate this milestone on your own.

Examples of founders who pitched their way to an exit

Here are a few deals we’ve covered where the founder pitched their way to an acquisition.

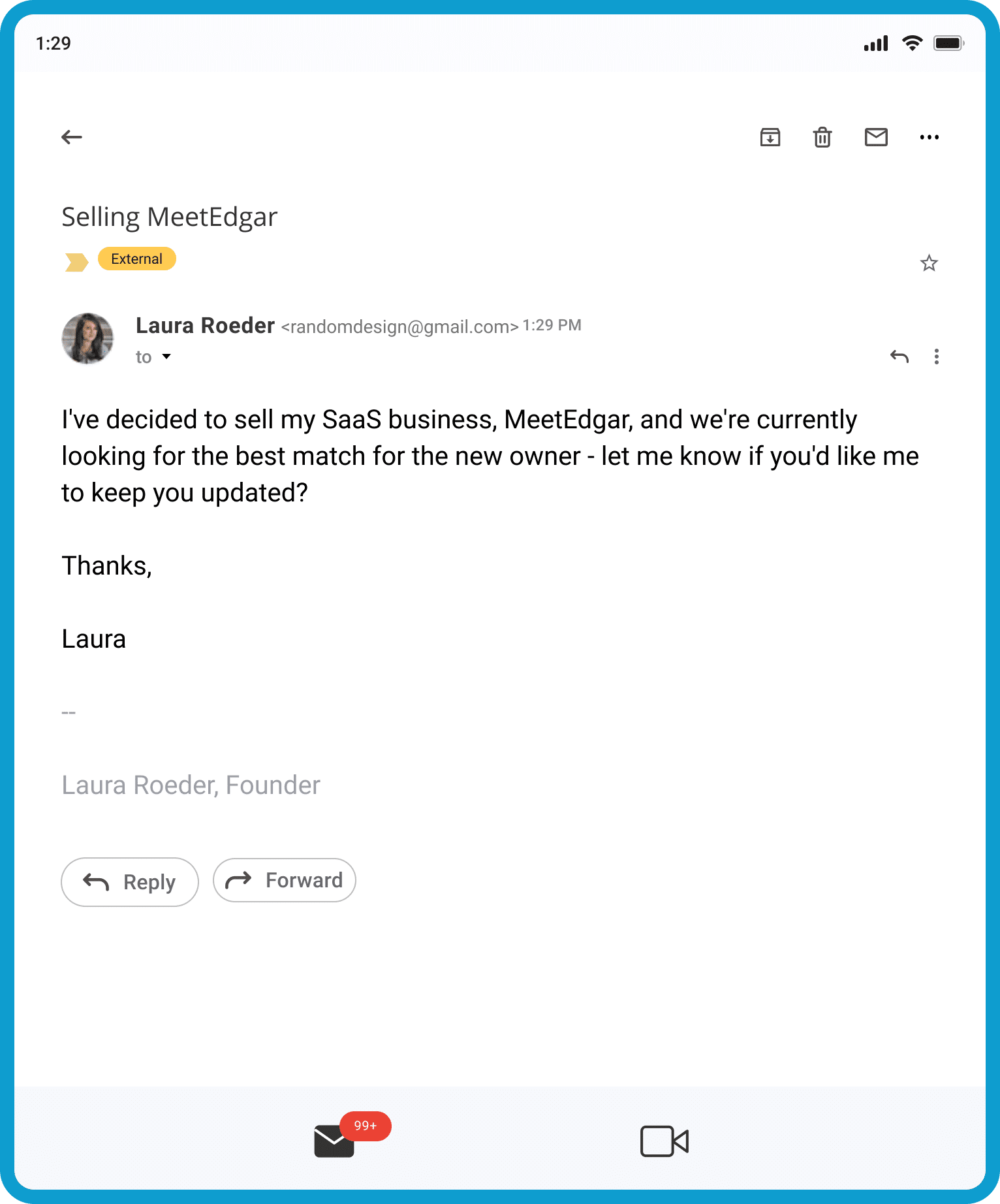

1. Laura Roeder of MeetEdgar

Roeder cold-pitched her buyer for MeetEdgar, a social media scheduling tool she sold for 7 figures in 2021.

She explains how she went about it in this blog post.

Here’s the email she used in her outreach:

“If they replied with interest, I sent over some very topline numbers like number of customers and annual recurring revenue, and from there we set up a phone call,” Roeder wrote.

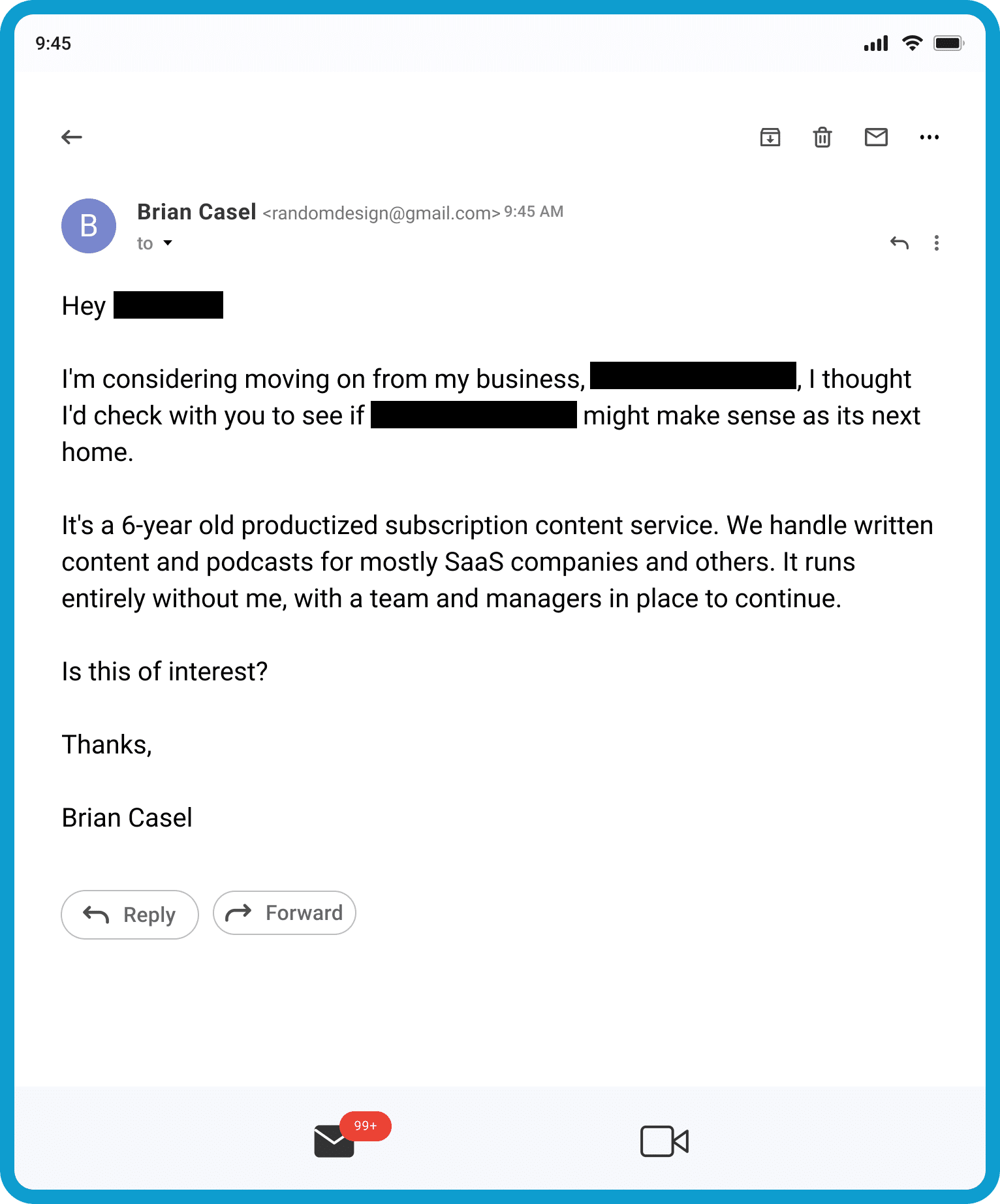

2. Brian Casel of Audience Ops

Casel found a buyer for his productized writing service company, Audience Ops, by reaching out to people he thought might be interested. He sold for high-6 figures in 2021, freeing him up to start a new business, ZipMessage.

He told us: “In my case, I reached out to 5-10 personal friends in our industry who fit this criteria:

– Has acquired or has the means to acquire a business like mine

– Has some strategic interest in my business

– I trust that they’ll keep this inquiry confidential”

He shared with us the email he used for initial outreach:

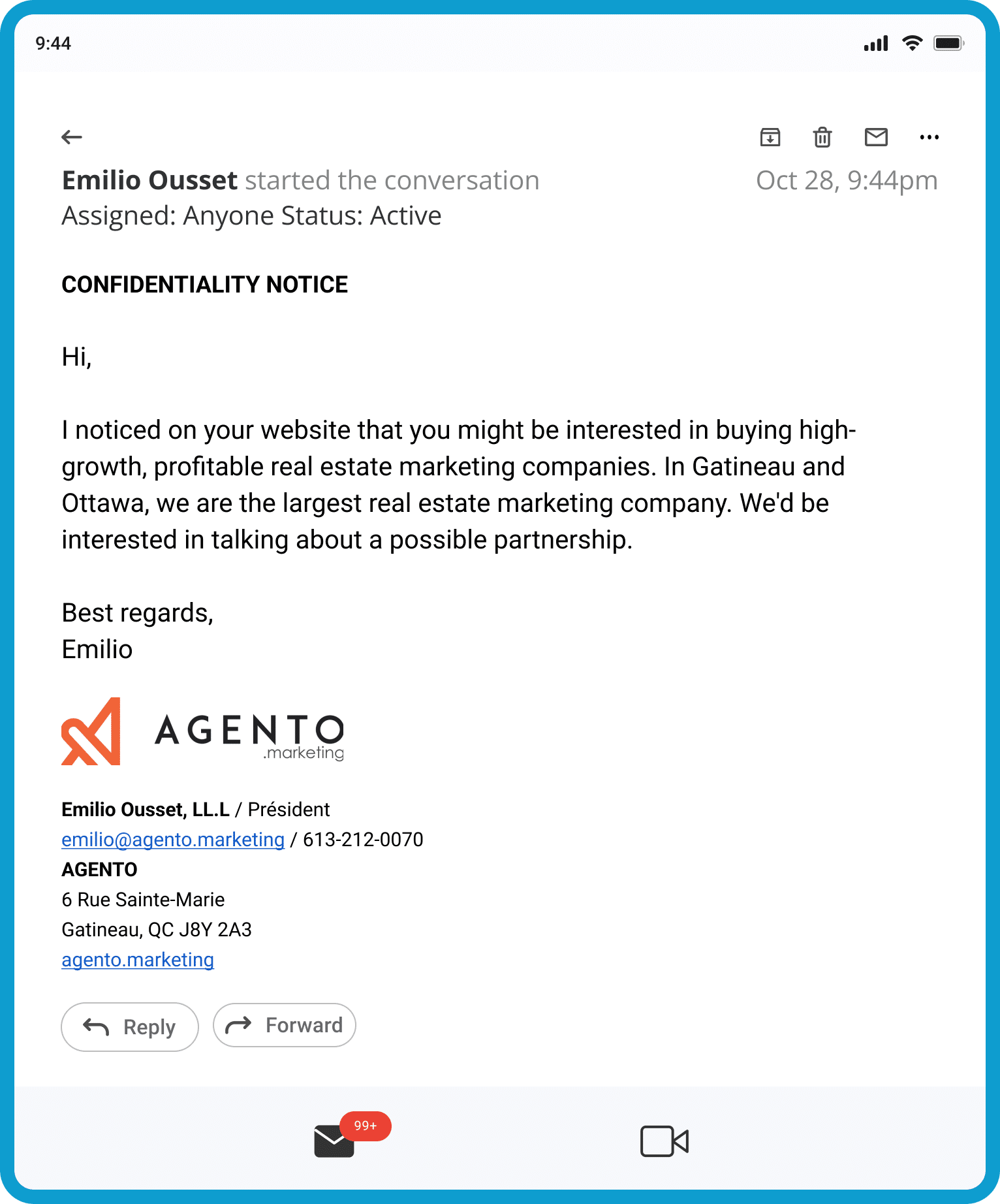

3. Emilio Ousset-Paciulli of Agento Marketing

Ousset-Paciulli sold his real estate photography business, Agento Marketing, in 2021 for about $880,000 in shares (including a $600,000 earn-out). He found his buyer by looking for companies that had purchased other businesses like his.

“Try to find companies that have synergy with yours,” he recommended. “They don’t need to offer the same services as you do.”

Here’s the email he used to pitch buyers:

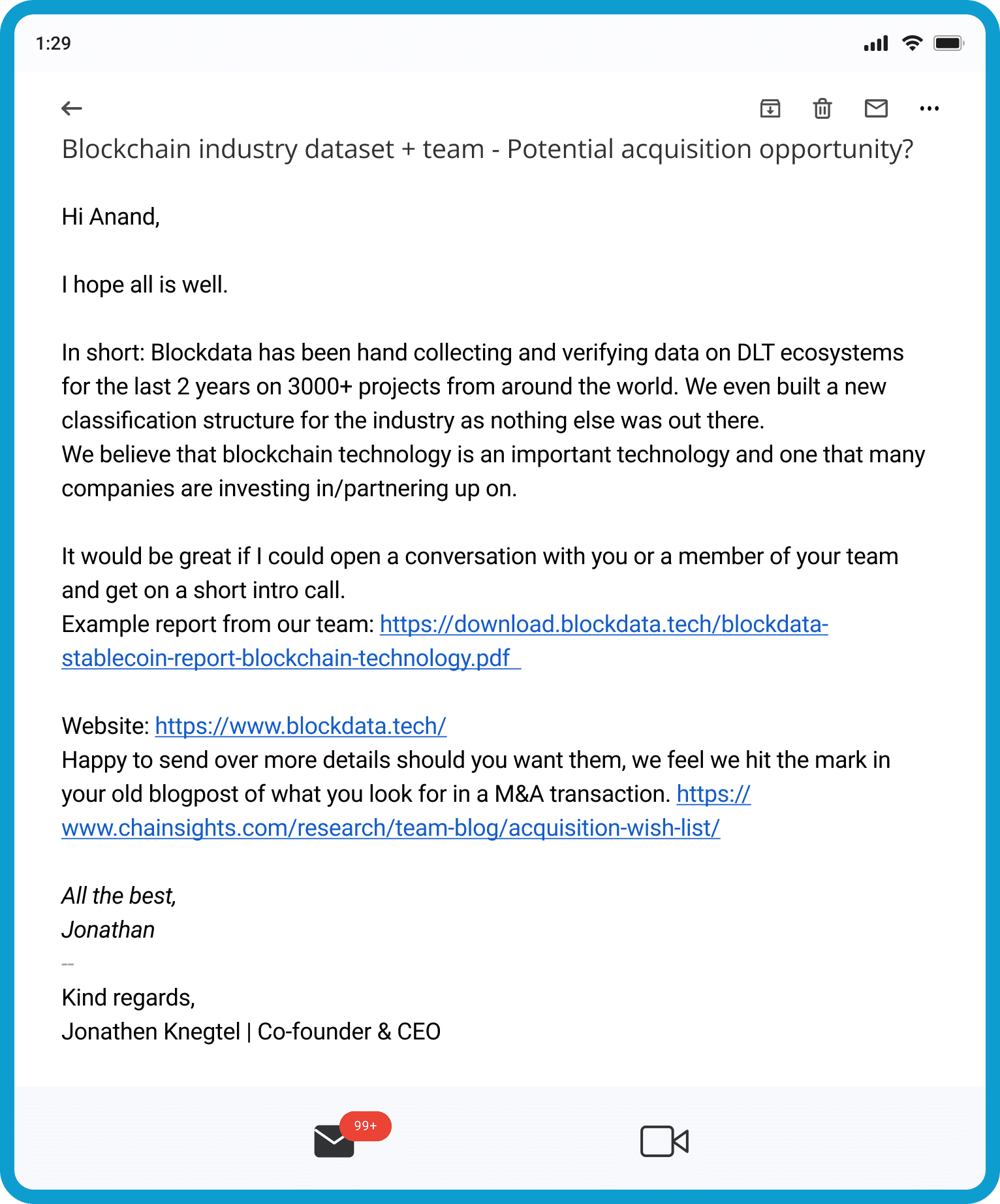

4. Jonathan Knegtel of Blockdata

Knegtel sold research company Blockdata in 2020 after reaching out directly to his ideal buyer.

“It really was as simple as sending an email,” he said on the Wharton Fintech Podcast. “It’s amazing how something so big can happen with something so small and so simple. But I basically just emailed Anand and said, ‘Look, we’ve been working on this data set for over two-and-a-half years now, and we’re looking at what the next step is, and we think CB Insights might be a good home for what we have.’”

Here’s the email he sent, per Wharton Fintech:

5. Ted Williams of Charlotte Agenda

Williams sold his local newsletter Charlotte Agenda to Axios for nearly $5 million in 2020. He wasn’t planning to sell, but he read an article about how Axios was expanding into local news — and he admired their approach.

So he reached out to the founder. After a brief email exchange, he had an initial 10-minute conversation with the buyer where he shared revenue, profit, and a ballpark asking price. “This transparency built trust and showed confidence,” he said.

His tip for sellers looking to approach their ideal buyer? “Be direct,” he said. “Leaders love this.”