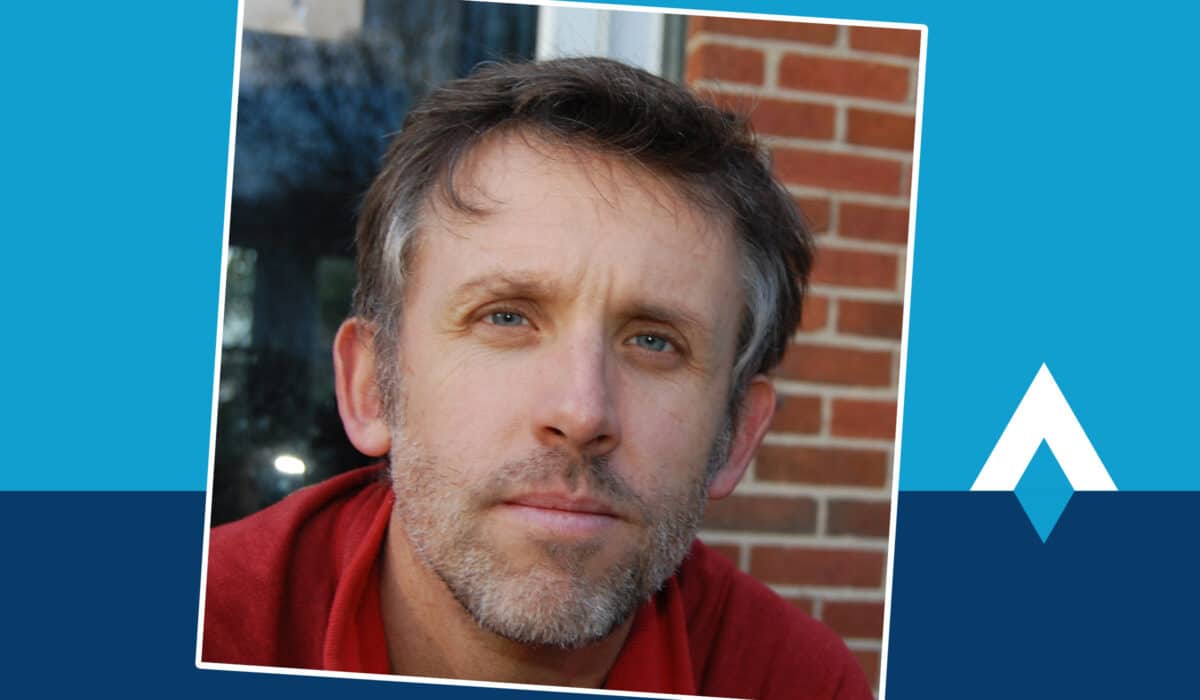

When Jonathan Knegtel co-founded Blockdata, his goal was to make the world of blockchain easier to understand for companies wanting to take the plunge.

As the company grew, Knegtel identified a solid match to potentially invest in Blockdata — or even buy it outright.

One well-worded email to Anand Sanwal at CB Insights changed the trajectory of his entrepreneurial career in a matter of months.

Demystifying blockchain’s tech

Jonathan Knegtel discovered the world of Bitcoin in 2012. He wasn’t someone who got rich quick in those manic early days of the technology, but he did gain a fascination about the transactional data inherent in blockchain’s development.

He worked at a variety of startups, with all his roles focused on data. In 2018 he struck out on his own, co-founding and serving as CEO for Blockdata with Bob van Ratingen (CTO), Niels Lucker (CMO) and Lucas Schewiger (CDO).

The database software company makes the world of blockchain easier to understand and analyze for companies and governments trying to decide which projects to pursue in the blockchain flow of so-called distributed ledgers.

Knegtel saw a big opportunity to track the blockchain ecosystem and increase awareness around adoption of the technology, he said on the Wharton Fintech Podcast in fall of 2020. “If [people] can’t actually surface the data and surface what’s going on, it’s going to be impossible for them to actually make decisions,” he explained.

Blockdata raised about $500,000 through angel investments in 2018 and 2019.

Over the course of two years, the team collected and verified data for more than 3,000 projects in the distributed ledger technology (DLT) ecosystem, and built a classification structure for the industry because one didn’t exist yet.

The art of the cold email

Blockdata’s early progress was impressive on its own. But Knegtel’s clear and concise email to Anand Sanwal in summer 2020 led to something even bigger. Sanwal, co-founder and CEO of CB Insights, was open to adding to his company’s offerings but hadn’t heard of Blockdata.

CB Insights is a platform that synthesizes and analyzes tech markets for clients, including large companies and governments. Before learning about Knegtel and Blockdata, Sanwal and his team knew that blockchain was more than just cryptocurrency, and recognized their clients would need more in-depth insights to decide which uses were worth pursuing.

Sanwal didn’t know a blockchain dataset like Blockdata’s existed until that email, he said in an interview with Your Story. “And then it appeared, and it was a great fit. We’re very open to possibilities and think about what could go right when we see a company,” he said.

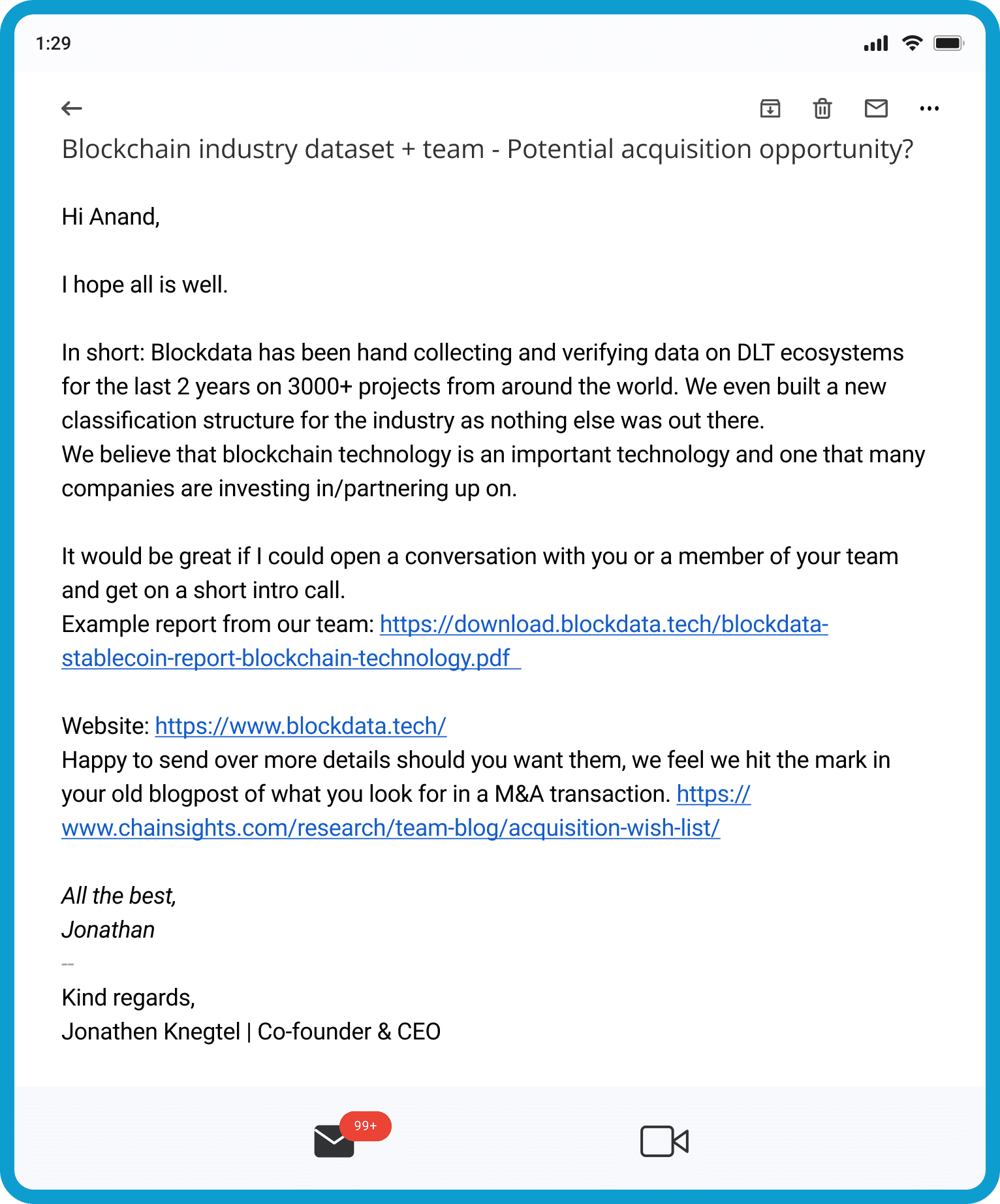

“It really was as simple as sending an email,” Knegtel recalled on the Wharton Fintech Podcast. In his initial message to Sanwal, he explained what Blockdata was working on, indicated they were interested in partnership opportunities, and thought CB Insights might be a good match.

But Knegtel’s email subject line deserves most of the credit. It read: “Blockchain industry dataset + team – Potential acquisition opportunity?”

Sanwal was used to getting emails from people interested in working together. But they often used “partnering” too vaguely for him to know what they were really after: an acquisition, or some other sort of collaboration.

“What he did was atypical and that actually just made it so we could jump into the fray really quickly,” Sanwal said on the Wharton Fintech Podcast.

Sanwal identified three factors that made Blockdata an attractive prospect: a depth of data regarding a unique ecosystem, a product that was tailor-made for that ecosystem, and a team that knew the space really well and deeply cared about the area of technology they specialized in.

The clarity of the match helped CB Insights’ plan to acquire Blockdata move quickly, despite constraints due to the Covid-19 pandemic. Conversations about the deal took place completely virtually.

Discussing a potential deal over video calls can make it hard to “feel someone out,” Knegtel said. But having “brutal honesty” between the two parties made it work. The two companies signed all the necessary paperwork over Zoom.

In September 2020, less than three months after Knegtel’s email to Sanwal, the sale was complete.

The terms of the sale have not been disclosed. Knegtel declined an interview request for this story.

Blockdata remained a standalone product with its own team of five, according to Coindesk, for which CB Insights opened an Amsterdam office. Knegtel stayed as CEO of Blockdata until June 2023, when he left the company.

Knegtel’s next step isn’t public just yet, but his new project, according to his LinkedIn profile, is in stealth mode.