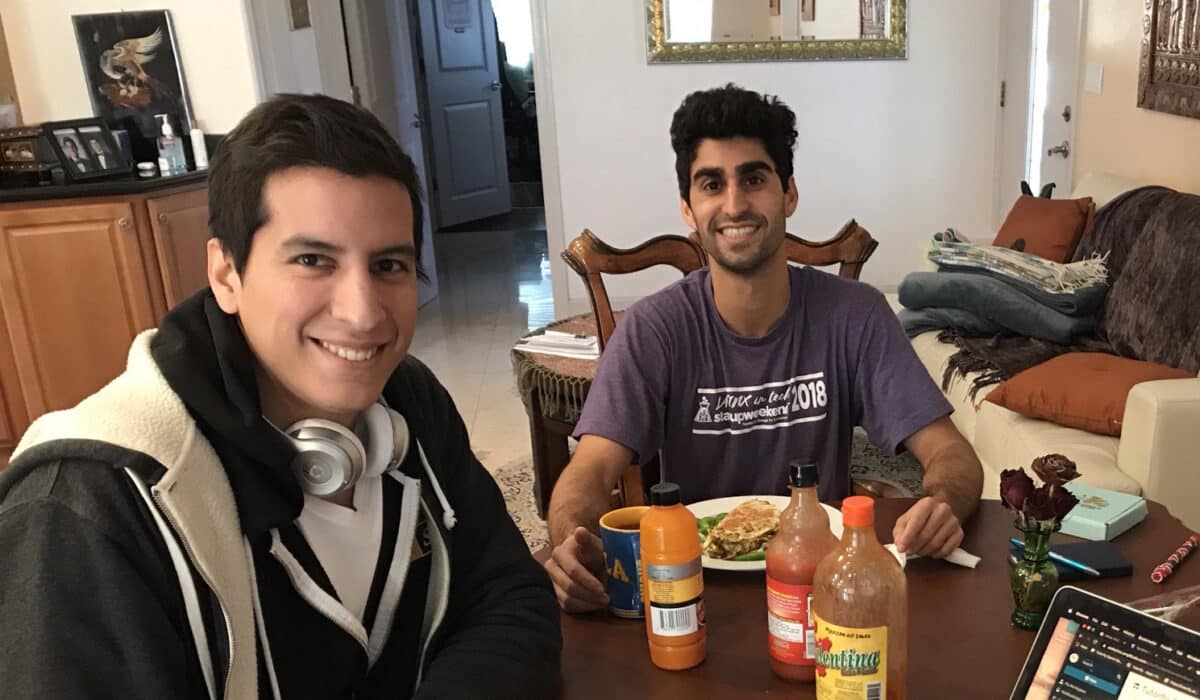

Parsa Rezvani loved tutoring grade-school students, especially the positive impact a recurring relationship with a tutor had on a student’s academic performance and mental health. His co-founder, Alejandro Mendoza, also had a passion for tutoring, having benefited from tutors during his schooling and worked as one through a homework hotline.

The two met through a mutual friend and created Tutorfly, a marketplace for parents to discover and connect with tutors for grade-school students.

They launched the business in 2017, when Rezvani was a student at UCLA and Mendoza was working as an engineer at Mint. “My parents immigrated to the U.S. from Iran in search of educational opportunities, which motivated me to start Tutorfly.com,” Rezvani wrote on his LinkedIn profile.

Rezvani focused on business operations while Mendoza took care of the programming, and the two collaborated on customer service and product development. They raised $500,000 from angels in the early days.

The biggest challenge Rezvani and Mendoza faced was building their initial customer base. They enjoyed some organic growth through Nextdoor.com and saw some success through a referral scheme. They offered $100 to tutors who referred 10 friends or colleagues.

“We had an average of three referrals per tutor on the platform, and this kept the quality of our tutors high,” Rezvani said.

Still, they wanted to grow faster, so they built a funnel. They listed Tutorfly on websites like tutors.com and thumbtack.com to piggyback on the huge volume of parents using those sites. By integrating with Thumtack’s API (and coding their own script to do the same with Tutors.com), the founders directed interested users to their CRM (customer relations management software), Hubspot, and linked that to a suggested tutor using their tutor recommendation algorithm. That automation decreased the friction and time for users between requesting and working with a tutor.

Then, an unexpected opportunity appeared: Covid-19. The pandemic and its corresponding cut in in-person interactions pushed parents to consider virtual tutoring options. Additionally, parents and advocates for kids gravitated towards personable educators, eager to replace meaningful relationships the students had lost. These two significant shifts drove Tutorfly’s growth.

Ahead of the sale, in 2020, the site had about 5,000 tutors and about 1,000 customers, though only a fraction of those were active at the time, Rezvani said. The business had exceeded $1 million in annual revenue, with total bookings through the site about $83,000 per month.

How a conflict of interest led to Tutorfly’s sale

In March of 2020, the founders also launched GoSchoolBox, a private label tutoring platform for tutoring companies. (“Private label” means the platform is branded with the name of the tutoring company rather than GoSchoolBox when used by customers.)

It started as a project to give back to the community during COVID, allowing schools and nonprofits to digitize their in-person tutoring and academic support. But it grew into something much bigger, and it left the two companies at risk of overlapping and competing. So the team decided to sell Tutorfly.

In November 2020, Rezvani and Mendoza enlisted a broker to find a suitable buyer: James Marciano of Tuck Advisors.

Ten months later, in September 2021, they sold Tutorfly to Kip McGrath Education Centres Ltd (ASX:KME). Known as Kip McGrath, the company provides tutoring services to children across 560 education centres globally.

Here were the terms of the deal, according to Kip McGrath:

- The company purchased a 70% stake for an initial $500,000 paid at closing, in a deal worth up to $3.5 million.

- Another $500,000 would be paid when Tutorfly hit $20,000 per month in net revenue.

- Plus $500,000 + $2 million in ASX:KME stock once Tutorfly hit $50,000 per month in net revenue.

Rezvani and Mendoza sold Tutorfly through an asset sale, with their new startup GoSchoolBox as the recipient of the funds. “The investors all wanted to rollover into GoSchoolBox,” Rezvani said. “Alejandro and I didn’t make any money from the sale but did prevent dilution for GoSchoolBox.” In other words, they were able to use those funds to avoid raising more money and giving away more equity in GoSchoolBox.

“If we succeed in achieving what we’re setting out to do, we will eventually be generously financially compensated,” Rezvani said. “If we don’t succeed in achieving our goals, then we won’t make a truckload of money, and that’s how startups work!”

Selling the company had many ups and downs, Rezvani said. Paramount to moving towards the finish line was being organized and having 1:1 meetings with the right people to keep the deal on track. But the most challenging part was planning a realistic transition plan. The founders knew they would exit the company at sale, and they were keen for it to continue to run well without them.

The founders had the option of selling the remaining 30% stake to Kip McGrath for $2 million in cash, an equivalent number of Kip McGrath shares or a mixture of cash and shares. The founders met the $50,000/month target earlier this year, and elected to take the payment in shares, Rezvani said.

Tutorfly sold for up to $3.5 million, with milestones for payments relying on net revenue. A previous version of this story misstated those terms. We share more about our reporting process here.